Personal Finance App Development: Steps to Make a Budget App

Budget planner apps are excellent tools for both businesses and individuals alike. Keeping track of finances is essential, but few people want to learn how to use Excel for this purpose. And even fewer people want to dig through piles of receipts to track expenses. In these cases, a budgeting app is a handy way of keeping a family budget on track and saving tons of time.

Okay, and how can it be useful to businesses? In a big company, a financial tracking app is a time-saver for the accounting department, and project managers, for instance. For freelancers and small businesses, it's a vital tool. A money management app allows independent contractors to focus on their main activities instead of maintaining an archive of inbound and outbound transactions.

Given the wide applicability and growth potential in the market, creating a budget planner app is a viable idea for start-ups. Start by studying your audience, once you know their pain points, you can create a valuable product that brings value to users and makes money for you. Also, make sure that you have at least a general idea of the market you’re about to enter.

In this guide on how to make a budget app, we help you dive deeper into the subject. Let’s first take a glimpse at market trends, and then a closer look at planning and developing a personal finance app. There are four steps to help you start your budget app project - defining the type of budget app to build, picking up the functionalities, choosing the monetizing strategy, choosing functionalities, and finding a balance between cost and quality.

Personal finance apps: Market overview

According to an Allied Market Research study, in 2019, the global market for financial planning web and mobile apps amounted to $1,024.35 million. By 2021, it’s expected to surpass $1,576.86 million as experts suggest that the Covid-19 pandemic is seriously contributing to the personal finance market’s growth. In response to lockdowns, banking institutions have developed a variety of digital tools and techniques, including personal finance software, to help customers and staff.

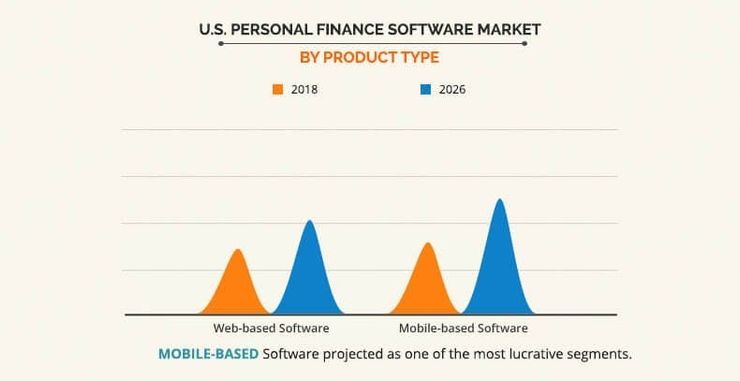

In 2019, web-based software dominated the personal finance software market (and it still does). Nevertheless, the popularity of money management apps is forecasted to grow rapidly over the next five years. Increased focus on digitising financial services, high demand for advanced financial tools at users’ fingertips, and the rising use of smartphones to manage all facets of life are all factors fuelling the market’s growth.

Source: Allied Market Research

In 2019, North America led the budget app development market with the highest growth rate, and it is expected to continue to dominate from 2021 to 2027. This region is powered by the swift adoption of new technologies and the presence of major industry players. However, with booming IT infrastructure and substantial investments from private and public sectors, the Asia-Pacific region is expected to experience a significant growth rate by 2027.

These regions are a gold mine for finance app start-ups, and it would be a shame to miss a piece of the multi-million pie. As new market players appear, though, the competition is going to get tougher. Take this into consideration and start working on your budget app now using the four-step guide below as a source of inspiration.

How to create a budgeting app in 4 steps

Step 1: Pick the type of budget app you want to build

There are several types of budgeting, aka money management, applications, which can be broadly divided into three distinct types:

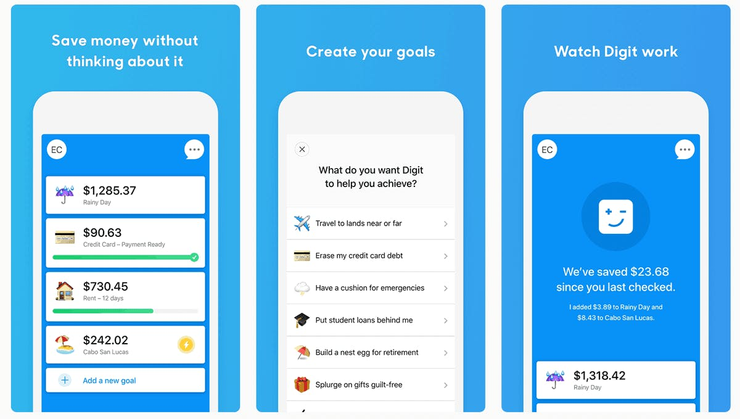

- Habit trackers such as MoneyHabit, Digit, and Empower. These money management apps monitor and analyse users’ spending habits with the help of artificial intelligence (AI) tools. Such apps track cash flow, help users understand their spending triggers, and acquire good money-management habits.

Source: AvocaDoughToast

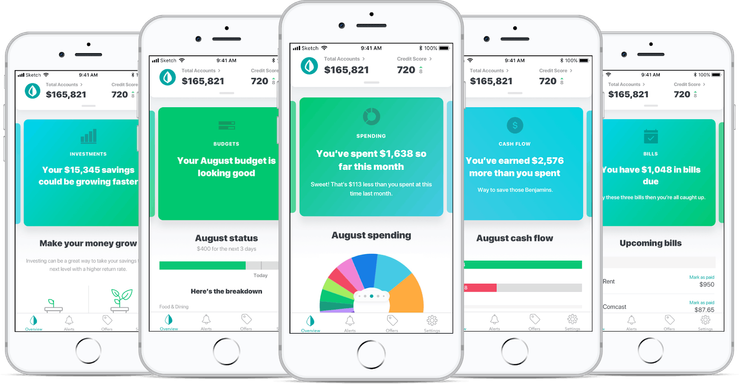

- Budget planners like Mint, PocketGuard allow users to set savings goals, analyse income and expenditure to calculate how much can be put aside, and automatically transfer savings to a “rainy day” account. PocketGuard even searches for better monthly deals on recurring expenses such as internet, TV, and phone.

Source: Pymnts

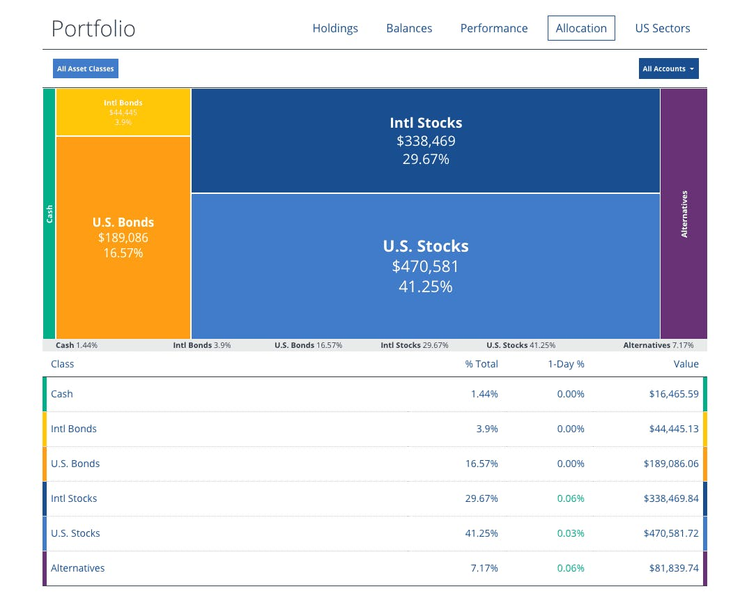

- Money managers including YNAB and Personal Capital track users' spending and allow them to plan monthly budgets. They also help users put their money to work by investing in stocks, bonds, and so on. For example, Personal Capital finds better deals, helps with building a retirement plan, and can find the best investment options.

Source: Money Under 30

In your personal finance app development, you can opt for one of these three app types, though, then you'll have a hard time competing with giants like Mint, YNAB or Personal Capital. The best way to succeed is to build a budget app that combines functionalities from various types of budgeting software.

For example, your product could track user spending patterns and recommend investments or strategies for debt reduction based on their spending habits. Add image recognition, voice input features, rigid security standards, and your smart budgeting app is ready for the market.

Step 2: Make a list of budget app features

Already know how your app should be? Make a list of its core features. Start with the following shortlist of key functionalities, these are must-haves in your software, be it a family budget app, or a finance tracker app for business:

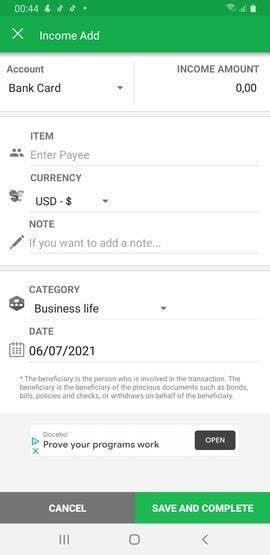

- Registration

- Log in and authorisation

- Personal profile with the settings section

- Tracking of spending and receipts

- Data analysis and reporting

What other functionalities could your budget app include? Your app's advanced features will depend on its type, and how you envision its functionality. Though, it’s a good idea to check your target audience’s expectations from a personal finance app. Do you know what features people find essential in budgeting apps? Here are a few to consider:

- Bank and payment systems integration –Making a budget app that links a user’s accounts together is really convenient as it will cover and monitor all their finances automatically. And when users get used to a certain level of comfort they don't go to other apps.

- Bank-level security – According to an RSA survey, one of people's biggest fears is losing control over their banking and other financial data. So, the higher the security of your budgeting application, the higher the level of user trust.

Not to mention, if you develop a budget app with access to banks, it must be compliant with local data processing and management standards. As with other finance app projects MadAppGang has completed, we recommend two-factor user authentication, data storage encryption, and enhanced network security.

Source: Biola University

- User-friendly design – Your personal finance app development plan should include the following: intuitive navigation, clear fonts and layouts, and high-quality data visualisation. The latter is crucial if you want to build a budget app that is appealing to users. Showing data in charts, for instance, makes it readily comprehensible.

Adding advanced features can make your budget app stand out from the crowd, consider voice input, and image recognition for receipt scanning. Building a budget app that takes the form of a game could be another way to differentiate your product. Games keep users engaged and motivated while planning their budget. If you show users that saving money can be fun and not torture, the chances are they’ll never go back to boring budgeting apps.

Step 3: Think about how to monetize your app

There is no universal monetization model for personal finance apps. The way you make money depends on your product's type and its target audience. If you develop a budget app like Mint, consider using Mint's monetisation model. This app is free but also offers a subscription plan with access to advanced features: a financial planner, personal accountant, and more. That said, subscriptions are not Mint’s main source of income, the app also suggests various bank products to users in exchange for affiliate commissions.

Don't be limited by one model as there are several widespread monetization strategies that you can mix and match for your project:

- Subscriptions – Charge users for using your services. Enable users to unlock your budget app’s full potential by subscribing and paying a monthly fee.

- In-app ads – You can make money placing advertising in your application. Though, be aware that users normally find in-app ads annoying. This means that you have to be very picky and only advertise relevant products.

- In-app purchases – Sell additional features and services, for instance, tax report preparation, personal accountancy services, and so on.

- Affiliate commission – Suggest the best financial products and services to your clientele and get a commission for every deal.

Step 4: Find a balance between cost and quality

As for any customised product, it's challenging to calculate the total sum you need to build a budget app. The cost depends on various factors including the number of features, third-party integrations, and deadlines, to name just a few. What is clear from the beginning is that hiring a development company like MadAppGang is the best way to find a balance between cost and quality.

Hiring freelancers looks like a cheap and reliable option at first glance, but it very frequently it turns out to be deceiving. Building an in-house team is time-consuming and far from being cost-efficient. Not to mention that in this case, you need to buy extra hardware and software just to build a budget app.

Meanwhile, by hiring MadAppGang, you get a complete team of experienced specialists: a project manager, front-end and back-end developers, UI/UX designers, and QA engineers. Not only will we develop any finance or e-commerce app for you, but we also help and assist at every stage including the planning stages and calculating the costs.

Wrapping Up

Global demand for money management apps is high, and it's going to grow in upcoming years. This type of software eases life for millions of individuals and thousands of companies. It comes in handy for family budgets, and with the rise of the gig economy, freelancers who need to track and record income and expenses need quality financial solutions. Personal finance applications are also useful for those who want to start investing but don't know where to start. Just about every individual and every company in all sectors need quality budgeting software.

So if you have a perfect personal finance application idea, it's time to capitalise on it. Decide on the type of budget app to build, the features you want to integrate, and how you're going to make money with the final product. Then, share your vision with us. It's our job to do the rest: make a smart and safe budget app to conquer the personal finance market.