Twilio Alternatives: How to Integrate Messages and Calls into Your App

Before the emergence of CPaaS, integrating a messaging feature into a business would take months. You would need to find a telecom service provider and set up a telephone exchange. Now, all of it can be handled by companies that provide dedicated services like programmable voice, SMS, chat, video, and so on.

What comes to a regular user as a feature seamlessly built into an application – whether that be a text message from Uber notifying clients that the driver has arrived or a direct call to an Airbnb host – is, in fact, a separate service. Businesses who need to implement such solutions have to wade through numerous options.

Twilio is the major industry player with more than 40,000 clients including globally recognisable brands such as Twitter and eBay. Wondering what does Twilio do exactly? They provide APIs for various communication channels. Twilio’s Voice API is their most in-demand product. The company boasts a revenue of $493.1 million a year, leaving their competitors far behind.

However, as always happens with rapidly growing technologies, many Twilio alternatives are eager to get their fair share of the market. Let’s find out whether they have something better to offer.

Twilio’s Success Story

After working in different companies, Jeff Lawson arrived at the idea that the overall success of any business lies in communication. Spotting some major flaws in the ways messaging functions were handled by startups, he came up with his own communication service.

Many investors became interested in the project because of Twilio’s developer-focused strategy. Interactive presentations during tech meetups when a company’s founder accentuated his speech with lines of code and an actual prototype engaged the audience and showed them just how much the Twilio team was dedicated to their work.

At first, Twilio provided voice-inside-apps services and then grew into a whole platform. Launched in 2008, the company gained impressive publicity only in 2011 when Uber became its client. It happened almost by chance: Uber’s partner, who provided the SMS service Air2Web, had a scheduled outage. While ride notifications were unavailable, Twilio jumped at the opportunity and within a month, Uber’s messages and notifications were enabled by Twilio. Now, its biggest clients are both the driving force and the drawback. It was estimated that in 2016, Uber and WhatsApp alone were responsible for nearly 20% of the company’s revenue.

Twilio’s Weak Spots

While Twilio is still the leading communication platform, it is not the sole company offering such services. In 2018, Twilio admitted it was focusing on growing in other regions including Japan, Western Europe, and South America. Back then, the company entered the Australian market and gained over 100 local clients including Atlassian and Dominos.

But still, it is stronger in North America while Twilio competitors have a wider presence in Europe and other parts of the world. Apart from the location, there are several more reasons why businesses seek alternatives.

Is Pricing for Twilio’s API the Biggest Hurdle?

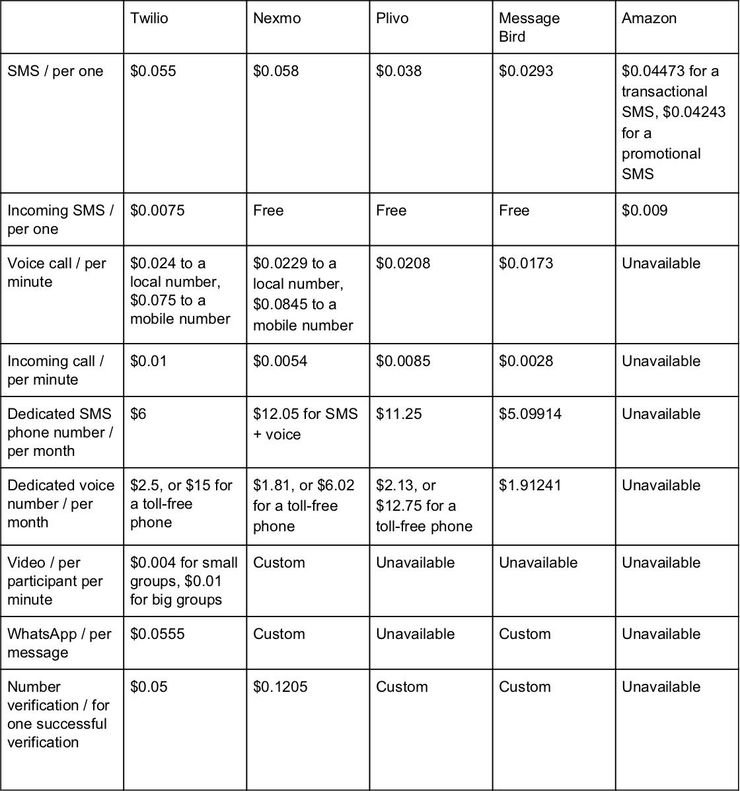

The pricing model is, without a doubt, the first thing any business would check before deciding on a provider. At the moment, all the vendors similar to Twilio offer lower prices. It seems that only Flowroute’s pricing is higher among such platforms. Since this company works only within the US and doesn’t expand globally like most other vendors, the Flowroute vs Twilio comparison doesn’t even make much sense.

A market analyst claims that Twilio API’s pricing is one of the biggest problems the company needs to solve. There’s an opinion that the company has practically no chances against the scale-out pricing model adopted by AWS Connect. To compete, the solution for Twilio might be to drop prices significantly. We will illustrate pricing differences using Australia as an example in the table below:

Moreover, helpful add-ons which are sometimes included for free in other providers’ packages (voice insights, conference calls, recording and storage, answering machine detection) all come with separate prices in Twilio’s case.

There are also differences in how providers charge for certain services. For instance, Twilio’s pricing for short code messages is based on consumption, while Plivo and Nexmo offer packages for three months.

Technical Issues

Another big issue with Twilio is that there’s a possibility the service wouldn’t report communication problems. You can find several similar complaints, for example, about SMS messages being marked as sent but not delivered. The crux of the issue is that Twilio wasn’t aware and therefore didn’t inform clients of the issue, charging the messages as if they were delivered.

While our MadAppGang team worked on an app for Russian truckers, we spotted a huge communication problem that went unnoticed by Twilio. We found out that Russian telecom operators were using Twilio according to a grey scheme which led to three-fourths of the messages not reaching the recipient. Naturally, we needed some local providers. We found one that didn’t have all the APIs our application needed so we developed some features ourselves.

Such experience shows that when integrating messages and calls into your app, you need to find the most suitable service and thoroughly test available solutions in the target area to ensure the quality of the product.

Twilio’s Competitors

So, what are the alternatives to Twilio and do these companies have other advantages besides pricing?

Nexmo

Launched in 2010, Nexmo’s unique proposition was to charge calls by the second and not per minute. The service uses adaptive routing techniques to deliver messages with the least traffic, supplies a shared short code number for free and doesn’t charge for incoming messages.

In 2017, Lyft initiated the Nexmo vs Twilio opposition by considering the former an alternative to the latter and starting using both services. An analyst argued that it was highly unlikely for other companies to provide the same level of quality for lower prices. But still, this move should be a bit of a wake-up call for Twilio.

A basic support plan with emails with response times up to four hours is free. A premium support plan costs $5,000 a month and includes phone and chat with response times of 30 minutes. There are several bundles available such as the Enterprise Bundle, with more functions included in a package.

Nexmo added some trending functions recently: an API for video calls and the integration of popular messengers like WhatsApp and Viber. It also offers individual services for separate pricing like Reporting API for $500 per month.

Plivo

Founded in 2011, Plivo now operates in over 50 countries providing voice numbers, and in 19 countries, providing messaging numbers. Call recording and storage are given for free. Every client can contact the support team through an online ticket system. Like most competitors, Plivo uses a call-routing tool to deliver messages in the fastest way possible.

When purchasing a dedicated phone number subscription, clients also receive conference calls, recording and storage, answering machine detection, and multilingual text to speech. Interestingly, the company addresses the Plivo vs Twilio competition rather boldly, claiming to be the only alternative to Twilio.

MessageBird

This startup was launched in the Netherlands in 2011. At the moment, MessageBird is a globally operating service with seven offices worldwide. It is quite popular in Europe and has the most potential there. Uber and Google are among their clients and popular messengers like WhatsApp and WeChat are integrated into the service.

MessageBird is working hard to enhancing user experience in communication. They recently introduced an API called Programmable Conversations that connects interactions performed via different channels: texts, calls, apps, and websites. Their video chatting feature is at the beta-testing stage.

MessageBird focuses more on enterprises, not app developers as Twilio does. The blogs published by the two companies illustrate this; while Twilio’s articles centre around technologies and development processes, MessageBird’s set out how to impact sales with the help of programmable SMS, calls, and emails.

The Others: Amazon Connect, Restcomm, Bandwidth

Amazon has been a Twilio partner. Twilio is hosted on Amazon Web Services and Amazon uses some of Twilio’s APIs. But, at the same time, the call centre launched by Amazon acts as a competitor to Twilio. Amazon Connect offers programmable SMS, mostly in the US. A dedicated short code costs $995 per month plus a setup fee of $650.

Restcomm stands out from the crowd because it’s an open source project with no prepaid billing or rating engine. It’s the only full-stack CPaaS which provides both mobile and web SDKs.

Bandwidth is the provider behind Google and Skype services that removes the middleman by owing the all-IP voice network. This company is mostly targeted at North America. Offering much cheaper prices than Twilio (compare $1 with $0.35 per month for a dedicated number), Bandwidth has the chance to win over major clients. As fore global presence, this service has only just started to spread to Europe and is not present on other continents yet.

Alternatives to Cloud-Based Services

There’s actually another possible solution, one which is much cheaper than the subscriptions we’ve described. If desired and where applicable, small startups can build their own GSM gateway for less than $100. Or, they can buy hardware like this one for hundreds of sim cards. Such devices need maintenance and monitoring but they could serve companies with moderate operational needs well.

What’s Next? Trends in Communication APIs

The CPaaS market has improved many business processes, giving startups the opportunity to integrate various communication features into apps without complicated hardware, or having to deal with telecom carriers. It has also brought about a reasonable pricing model based on consumption. At the moment, most CPaaSs provide serverless architecture, which eliminates the servers that need to be handled on the client’s side.

Another significant trend is related to the omnichannel experience. Businesses are starting to implement Rich Communication Services, which represents a relatively new channel for communication platforms to adopt. In general, we predict that omnichannel experience will be driving the market in the near future.

Adding messaging APIs for WhatsApp is a step already taken by Twilio, Nexmo, and MessageBird. WhatsApp is not only a popular communications channel but also a reasonable replacement for telecom operators in some parts of the world. For instance, in Europe an ordinary text message can cost 10 cents – too much for regular texting with Twilio’s SMS API.

Owing to machine learning and AI, CPaaS companies can consider developing bots. Twilio already joined the game with Twilio Autopilot features allowing for the creation of smart bots for calls and chats. While an interactive voice response system is a norm and used by the majority of companies, intelligent bots are a function to look forward to.

There are also new security threats emerging that require new approaches. The growing problem of message and call log exposures require that vendors improve their security measures.

At the end of the day, we can’t say for sure whether other companies will gain more clients and steal the lion’s share of the market from Twilio. But what is clear is that all communication providers should focus on making their services highly diverse and adaptable.

If you’re wondering which communication platform is best in your application, please reach out to us and we’d be happy to talk it over with you.

13 July 2019