Building Australia's #1 Energy Orchestration Platform

How We Built a Real-Time AI That Trades Energy Every 5 Minutes for Tens of Thousands of Assets

Go

Kafka

AWS

Kubernetes

MongoDB

Machine Learning

Real-Time Systems

API Design

The $150 Day

One customer made $150 in a single day from their home battery.

Not from installing solar panels. Not from a government rebate. From trading electricity while they were at work.

Here's what happened: On a scorching February afternoon in Sydney, air conditioners across New South Wales switched on simultaneously. The electricity grid strained. Wholesale prices spiked to over $10,000 per megawatt-hour—nearly 1,000 times the normal rate.

At 2:47 PM, an AI made a decision.

It told this customer's battery—which had been quietly charging all morning when electricity was cheap—to start selling power back to the grid at peak prices. The customer didn't press any buttons. They didn't even know it was happening. They just got a notification that evening: "You earned $150 today."

That's not magic. That's what happens when you build an AI that thinks faster than the market.

We built that AI.

But this story doesn't start with the $150 day. It starts with a company that almost didn't survive.

The Numbers

| Metric | Result |

|---|---|

| Optimization cycles | 288 per asset per day |

| Command latency | Under 1 minute to analyze and command |

| FCAS response | Sub-100ms (fastest in Australia) |

| Platform uptime | 99.99% |

| Customer savings | 26% more than standard solar+battery |

| Scale | Gigawatt-scale DER orchestration |

Evergen started as a prototype that couldn't scale. The board replaced leadership. Ben Hutt (CEO), Ben Birns (COO), and Nick McGrath (CTO) rebuilt the company from scratch—keeping only the core algorithm. MadAppGang came in as the squad team that could deliver the impossible. Five years later: Australia's leading DERMS platform, acquired by Intellihub, backed by $100M government investment. This is the story of what we built together.

The Prototype That Couldn't Scale

Evergen began as a research project with a brilliant idea: What if you could make home batteries smart enough to trade electricity automatically?

The prototype worked. The algorithm—the mathematical brain that decided when to charge and when to sell—was genuinely innovative. It could predict electricity prices, learn household energy patterns, and make profitable decisions.

But a working prototype isn't a company.

By 2018, Evergen had proven the concept but couldn't grow. The software was built for demonstrations, not for thousands of real customers. The infrastructure couldn't handle scale. Every new feature required heroic effort from engineers who were already stretched thin.

The board saw what was coming: either transform the company or watch it die slowly.

They made a hard call. They replaced the CEO and COO.

Ben Hutt came in as the new CEO. Ben Birns as COO. Their mandate was clear: rebuild the company from scratch. Keep what works—the core algorithm—and rebuild everything else.

Ben Hutt's first move was hiring Nick McGrath as CTO. Nick looked at the technology and gave a blunt assessment: "The algorithm is solid. Everything around it needs to be torn down and rebuilt. And we need to move faster than anyone thinks is possible."

That's when they brought us in.

The Squad That Does the Impossible

MadAppGang joined as what Nick called "the squad team"—a group that could deliver what hadn't been built before, on timelines that seemed unrealistic.

Here's what we inherited:

- A Matlab algorithm that worked but couldn't scale

- Infrastructure held together with duct tape and hope

- 400 customers who were essentially beta testers

- A roadmap of features that competitors were already building

- About 18 months before the market window closed

The energy industry was waking up to distributed energy. Big players—utilities, retailers, tech companies—were all racing to build what Evergen had proven was possible. If we couldn't scale fast enough, we'd be crushed by companies with deeper pockets.

The algorithm was the seed. Everything else—the monitoring systems, the control infrastructure, the integrations, the trading platform—had to be built from the ground up.

This is the story of what we built.

How Home Energy Actually Works

Before we get technical, let's make sure everyone understands what's actually happening when you put a battery in your home.

The Old World: One-Way Power

Traditionally, electricity flows one direction: from power plants to your home. You consume it, you pay for it, end of story. The price on your bill is averaged—you pay the same rate whether electricity is abundant or scarce.

The New World: Two-Way Power

Solar panels changed this. Now your home can generate electricity, not just consume it. When the sun shines, you might produce more than you need. That excess has to go somewhere.

Most people just send it back to the grid for a small credit. But here's what they don't realize: electricity prices aren't actually flat. They change constantly—every five minutes in Australia. Sometimes power is nearly free. Sometimes it costs 1,000 times more.

The Opportunity

If you have a battery, you can play this game:

- Charge the battery when electricity is cheap (middle of the night, or midday when everyone's solar is pumping)

- Discharge the battery when electricity is expensive (hot afternoons, cold evenings)

Do this well, and you can earn real money. Not just "save on your electricity bill" money. Actual cash.

The problem? No human can do this manually. Prices change every 5 minutes. Optimal decisions depend on weather forecasts, your personal usage patterns, grid conditions, and market predictions.

You need an AI that never sleeps, constantly watching, constantly optimizing.

That's what we built.

System 1: Real-Time Monitoring (The Eyes)

What it is: A system that watches every battery, every solar panel, every inverter in the network—live, all the time.

Why it matters: You can't control what you can't see.

The Problem We Solved

Imagine you're managing 10,000 home batteries across Australia. Each one is made by a different manufacturer—Tesla, LG, Enphase, Fronius, Alpha ESS, Duracell. Each manufacturer has their own way of reporting data. Their own API. Their own quirks.

Tesla's Powerwall API authentication expires every 24 hours. You'd wake up to find hundreds of batteries had gone silent overnight.

Enphase returns solar data in different units than everyone else. You'd see numbers that looked right, do the math, and realize you were off by a factor of 1,000.

One manufacturer had literally never received feedback on their API. When we showed them our integration notes, their engineers were shocked. "Nobody ever told us this was broken."

What We Built

A unified monitoring layer that speaks every manufacturer's language and translates it into one consistent format. Energy retailers don't need to know that Tesla's auth expires, or that Enphase uses weird units. They call our API and get clean, consistent data.

This abstraction layer took months to build. It's also why Evergen can onboard new hardware manufacturers in days, not months.

The system now monitors tens of thousands of assets in real time. Every battery's charge level. Every solar panel's output. Every inverter's status. Streaming constantly via Kafka.

System 2: Real-Time Control (The Hands)

What it is: The ability to command any battery in the network—charge, discharge, or hold—remotely, instantly.

Why it matters: Monitoring tells you what's happening. Control lets you do something about it.

The Problem We Solved

The original system had control logic scattered across 47 different database stored procedures. Nobody knew exactly what they all did. Making changes was terrifying—fix one thing, break three others.

Some commands took minutes to reach devices. In a market where prices change every 5 minutes, a 2-minute delay means you've already missed your window.

What We Built

A single, testable control service that can command any device in under 60 seconds. The command goes out, the device acknowledges, and we verify it actually happened.

This sounds simple. It wasn't. Different manufacturers handle commands differently. Some acknowledge immediately but execute slowly. Some execute immediately but don't acknowledge. Some just... don't respond sometimes.

We built retry logic, acknowledgment verification, and timeout handling for each manufacturer's quirks. The retailer just says "discharge this battery at 50%." Our system figures out how to make that actually happen.

System 3: Personal Energy Optimization (The Brain)

What it is: An AI that creates a personalized energy plan for each home, updated every 5 minutes.

Why it matters: This is where the money is made. Get optimization right, and customers earn more. Get it wrong, and you're leaving money on the table.

How It Works

The AI considers:

- Weather forecasts: How much solar will this house generate today?

- Market predictions: When will electricity prices spike or crash?

- Personal patterns: When does this family typically use power? When do they leave for work? When do they run the dishwasher?

- Battery state: How much charge is stored? How much capacity is available?

- Grid conditions: Is the network stressed? Are there demand response events?

Every 5 minutes, the AI recalculates the optimal action for every battery in the network. Charge, discharge, or hold. Repeat 288 times per day.

The Problem We Solved

The original algorithm was a Matlab model inherited from another company. The engineer who'd connected it to production had left. Nobody fully understood how it worked.

It did work. But it couldn't learn. It couldn't improve. It was frozen in place while the market evolved around it.

What We Built

A proper machine learning system with:

- Feedback loops: The AI learns from every decision. If it predicted a price spike that didn't happen, it adjusts.

- Continuous training: The model gets smarter over time, not stale.

- Per-site personalization: Each home gets its own optimization profile based on its specific patterns.

The Result: Customers using Evergen's optimization save 26% more on electricity bills compared to standard solar+battery setups. Validated across the entire customer base.

That's not "up to 26%." That's the measured average.

System 4: FCAS—Frequency Control (The Reflexes)

What it is: A system that responds to grid emergencies in milliseconds.

Why it matters: This is where serious money is made—and where milliseconds literally mean dollars.

What is FCAS?

The electricity grid is like a tightrope walker. It must stay perfectly balanced—electricity generated must exactly equal electricity consumed, every second.

When something unexpected happens—a power plant trips offline, a sudden surge in demand—the grid frequency drops. If it drops too far, bad things happen. Blackouts. Equipment damage. Cascading failures.

This is where FCAS (Frequency Control Ancillary Services) comes in.

The grid operator pays batteries to be on standby, ready to inject power the moment frequency dips. It's like being paid to be a backup generator. But you only get paid if you can respond fast enough.

The minimum requirement: respond within 6 seconds.

The Problem We Solved

6 seconds is the floor. It gets you into the game. But faster response means you capture more of the event—you're already discharging while competitors are still waking up. More energy delivered means more money earned.

What We Built

Sub-100 millisecond response time.

When grid frequency drops, our system detects it, calculates the response, and sends commands to batteries in under 100 milliseconds. That's faster than you can blink.

This isn't a marketing claim. It's measured, verified, tested repeatedly. The fastest FCAS response in Australia.

System 5: Virtual Power Plant Trading (The Trader)

What it is: A system that aggregates thousands of home batteries and trades them as if they were a single power plant.

Why it matters: Individual batteries are too small to participate in wholesale energy markets. Combined, they become a force.

What is a VPP?

A Virtual Power Plant (VPP) is exactly what it sounds like—a "power plant" made of distributed resources instead of a central facility.

Instead of one massive generator, you have 10,000 home batteries. Individually, each is tiny—maybe 10-15 kilowatt-hours. Combined, they're a significant resource: 100-150 megawatt-hours. Enough to matter.

The VPP operator (Evergen) aggregates all these batteries and presents them to the market as a single entity. The market doesn't know or care that it's actually thousands of homes. It just sees reliable capacity that can be dispatched on demand.

The Problem We Solved

Participating in wholesale energy markets isn't like selling on eBay. There are:

- Complex bidding rules

- Rebidding windows

- Compliance requirements (the documentation alone was 200+ pages)

- Penalties for failing to deliver what you promised

- Multiple market types (wholesale, FCAS, demand response)

Get the bidding wrong and you lose money. Promise capacity you can't deliver and you get penalized. Miss a rebidding window and you're locked into a bad position.

What We Built

Automated market bidding that:

- Predicts available capacity across the entire fleet

- Places optimal bids based on market conditions

- Rebids automatically as conditions change

- Manages compliance across multiple market types

- Tracks settlement and reconciliation

The $150 Day, Explained

Now you understand how one customer made $150 in an afternoon.

The VPP predicted a price spike. It positioned batteries across the network to discharge at peak prices. When wholesale prices hit $10,000/MWh, the VPP sold. The earnings were distributed back to the battery owners.

That customer didn't do anything. The AI did it for them.

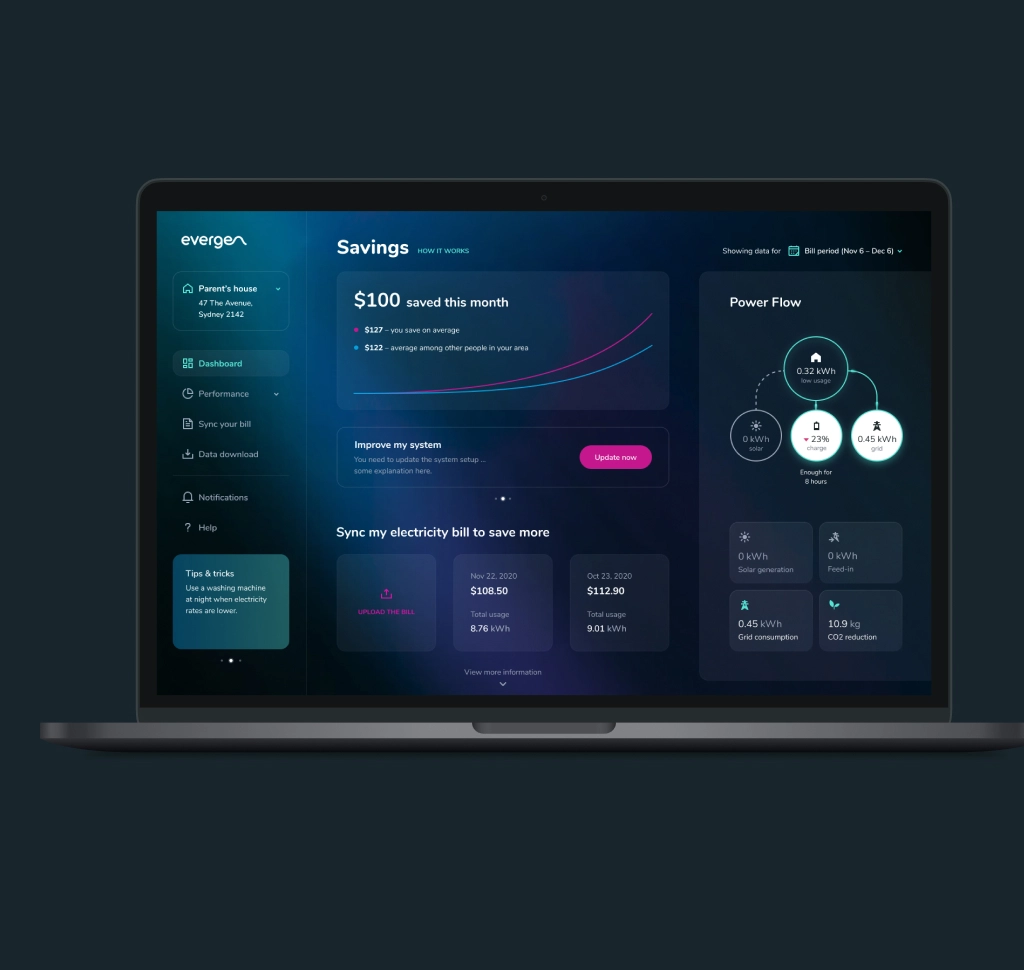

System 6: DERMS—The Platform Business (The Product)

What it is: A white-label platform that lets other energy companies run their own Virtual Power Plants using Evergen's technology.

Why it matters: This is what transformed Evergen from a startup into an acquisition target.

What is DERMS?

A Distributed Energy Resource Management System (DERMS) is the complete package—monitoring, control, optimization, trading—all wrapped up as a platform that other companies can use.

Think of it like this: Evergen could have stayed a retail VPP company, signing up individual customers one by one. Instead, they built the platform that other VPP companies use.

It's the difference between being a taxi driver and being Uber.

The Problem We Solved

Energy retailers—EnergyAustralia, Origin, AGL—all wanted VPP capabilities. But building what we built takes years and specialized expertise.

They had two choices: build it themselves (expensive, slow, risky) or license from someone who'd already built it.

What We Built

A complete DERMS platform with:

- External API: Third-party integrations for retailers and grid operators

- Mobile API: White-label customer-facing apps

- OEM APIs: Pre-built integrations with every major hardware manufacturer

- Device Telemetry API: Real-time data streaming at scale

Energy retailers plug into our platform and instantly get monitoring for any hardware manufacturer, control capabilities for their entire fleet, optimization that's already proven, and market participation without building trading infrastructure.

Who Uses It

- EnergyAustralia: One of Australia's largest retailers, tens of thousands of assets, growing

- Bunnings: Yes, that Bunnings—powering their energy offering

- Poolwerx, Enreal: Major Australian brands

These aren't customers of Evergen's VPP. They're customers of Evergen's platform. They run their own VPPs using our technology.

That's the business that got acquired.

"The platform Jack's team built handles millions of optimizations in real time with 99.99% uptime. Our FCAS response is the fastest in Australia—sub-100 milliseconds. That's not marketing, that's measured. When you're trading in wholesale energy markets, every millisecond of latency is money. MadAppGang understood that from day one."— Nick McGrath, CTO, Evergen

The Acquisition

By 2023, Evergen had transformed from a struggling prototype into Australia's leading DERMS platform.

Intellihub—owned 50/50 by Brookfield and Pacific Equity Partners—manages 2.5 million smart meters across Australia and New Zealand. They weren't looking for customers. They weren't looking for a brand.

They wanted the platform.

The DERMS we spent five years building is now central to Intellihub's strategy for the Australian energy transition.

How central? The National Reconstruction Fund Corporation (NRFC)—that's Australian government money—invested $100 million specifically for Evergen platform upgrades.

That's not a startup getting seed funding. That's a government betting on the technology we built to power the national energy transition.

"When Intellihub acquired us, they weren't just buying a company—they were buying the platform. The DERMS we built with MadAppGang is now central to Intellihub's strategy for the Australian energy transition. The $100 million NRFC investment is specifically for platform upgrades. That's the kind of validation you can't fake."— Ben Hutt, CEO, Evergen

Five Years and Counting

Five years. Not a project—a partnership.

We started as a small squad embedded with Evergen's team. Today:

- ~2/3 MadAppGang engineers, ~1/3 local Sydney team

- Not two separate teams—one integrated team

- Grown from 3 engineers to 70+

- Continued through the Intellihub acquisition

We didn't build for Evergen. We built with them. When they got acquired, we stayed. We're still building it.

When This Matters to You

You need someone like us when:

- Your startup has proven the concept but can't scale

- You need to integrate with dozens of third-party APIs that weren't designed to work together

- Your AI needs to work in production, not just notebooks

- Milliseconds actually matter for your business

- You're building the platform your company sells, not just uses

- You need to move faster than anyone thinks is possible

See also: The technical deep-dive into the legacy migration that made all this possible.

Talk to Us

We've spent five years building energy tech that trades millions of dollars in real time. The lessons apply beyond energy—any platform where speed, reliability, and integration complexity matter.

60 minutes with our CTO. We'll tell you honestly whether we can help.

What real-time platform are you trying to build?

Industry: Energy Technology

Duration: 5 years (ongoing partnership)

Team: ~2/3 MadAppGang, ~1/3 local Sydney (integrated team)

Stack: Go, Kafka, AWS, Kubernetes, MongoDB, Machine Learning

Outcome: Acquired by Intellihub, $100M NRFC investment